Is Cleavland Cliffs Going to Pay a Dividend Again

Bet_Noire/iStock via Getty Images

Article Thesis

On the back of a recovering economy and a building blast, Cleveland-Cliffs, Inc (NYSE:CLF) and its peers from the steel industry in Due north America have had a strong year. Shares have performed well over the concluding year, just CLF and other steel players have declined considerably over the final couple of weeks. This has resulted in multiple compression that has made the stock even cheaper based on current estimates for this twelvemonth, only it seems pretty clear that Cleveland-Cliffs, Inc volition not be this profitable in the coming years. Withal, at electric current prices, the company's stock is so inexpensive that it could be a solid investment for those investors that can stomach the cyclicality of the concern.

CLF Stock Cost

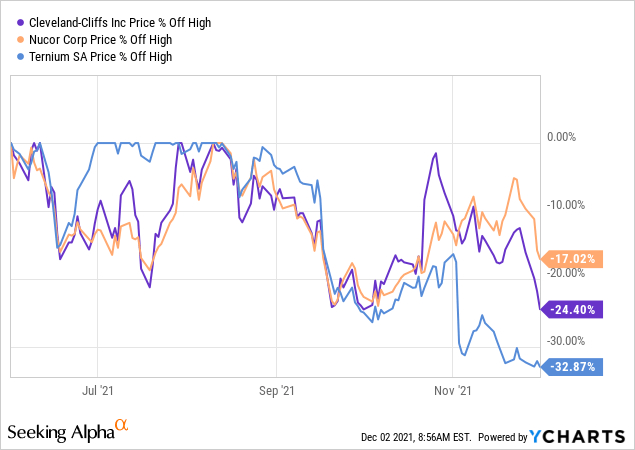

Cleveland-Cliffs, Inc has seen its shares ascension from a little less than $12 to more $26 betwixt December 2020 and August 2021, for a highly attractive return of more than 100% in less than a year. Shares peaked in August, nonetheless, and have been trending down since and so, with the sell-off accelerating over the last couple of weeks:

Cleveland-Cliffs, Inc has dropped by 24% since information technology hit its top, with steel peers Nucor (NUE) and Ternium (TX) dropping by relatively comparable amounts of 17%-33% from their corresponding peaks. The sell-off was not based on company-specific news, but rather driven by a combination of the post-obit factors:

- The market started to price in that profits in 2022 will likely be lower than in 2021 for steel players

- Investors that bought up shares earlier the infrastructure bill passage in hopes of a quick trade exited their positions once again every bit the bill had been passed

- More recently, with the new COVID variant Omicron gaining attention, markets sold off cyclical, volatile stocks such as steel manufacturers in order to deploy their money in less cyclical safe-haven stocks.

All of these factors combined take made the shares of CLF and its peers significantly less expensive than they were during the summer months. Based on electric current earnings estimates, Cleveland-Cliffs trades at a very inexpensive 3.2x earnings multiple -- which tells us, of form, that it is highly unlikely that profits will remain this loftier in the coming years. Looking at Wall Street estimates, we run into that Cleveland-Cliffs supposedly has a lot of upside potential -- the consensus cost target is $30, which implies an upside potential of a petty more than than l% over the next twelvemonth.

A Leading Steel Histrion With An Attractive Portfolio

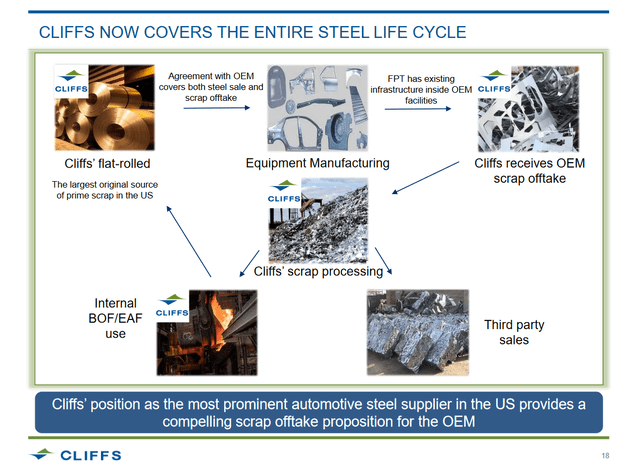

Cleveland-Cliffs, Inc is not the largest steel player in terms of market capitalization, but the company is a leading flat-rolled steel manufacturer in North America. Its operations are diversified across cease markets, and the company has been working on condign a fully integrated steel actor, which ways that CLF does excerpt some of the raw materials it needs for its steel business, simply the company besides is active in recycling, which includes, for example, bit offtake agreements with its customers in the car industry. This, in turn, allows CLF to utilize said scrap to industry steel in the future:

Source: Cleveland-Cliffs presentation

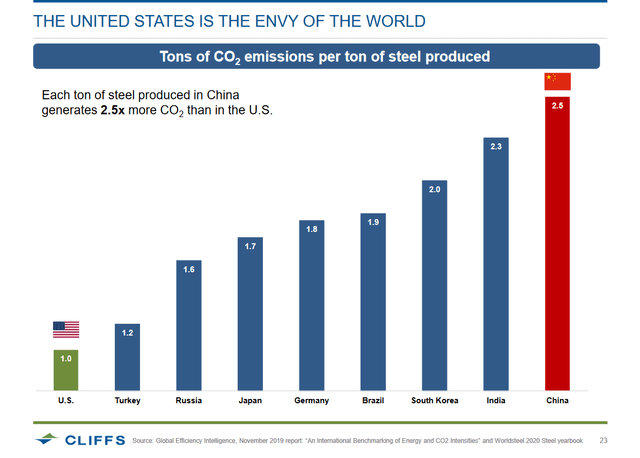

In the in a higher place slide, nosotros run across what CLF calls the steel life cycle. As the number ane supplier for flat-rolled steel to the U.s. auto industry, CLF is well-positioned to handle the scrap from these companies (frequently scrap offtake is included in steel sales contracts between CLF and auto players). Cleveland-Cliffs tin then use the fleck the company receives for future steel manufacturing, or to process and sell it to third parties. Being able to reuse flake to a big degree goes paw in paw with a beneath-average ecology affect for Cleveland-Cliffs' business on a per-ton basis, compared to steel players that utilize less bit metal (particularly in other countries with less strict pollution standards). Combined with other ESG measures, such as usage of pellets instead of sinter, this has immune CLF and its peers to become some of the least environmentally damaging steel producers in the earth:

Source: Cleveland-Cliffs presentation (linked above)

With significantly cleaner steel manufacturing in the US, compared to virtually other major producers, Us steel companies such as CLF are in an advantaged position from an ESG perspective. They should do good from growing demand, every bit customers want to buy cleaner steel, and they should too meet their stocks benefit, as U.s. steel equities are more favorable from an ESG perspective compared to steel equities from most other countries.

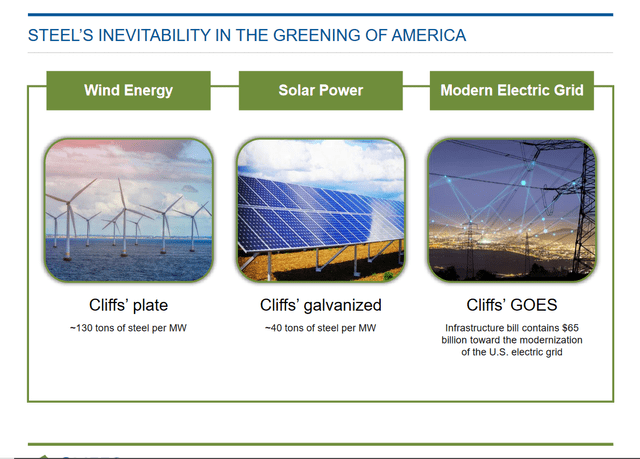

The longer-term growth outlook for Cleveland-Cliffs is solid, as the company volition benefit from a range of megatrends that should see steel demand remain good for you. Steel is, for instance, required in the build-out of renewable energy infrastructure:

Source: Cleveland-Cliffs presentation (linked above)

With massive investments in wind power, solar power, and electrical grid upgrades expected for the coming years (and probable decades), in that location is meaning market potential for CLF and its peers. Since renewable free energy buildout will, in order to see emission reduction goals, be required no matter whether the economic system is in a stiff spot or not, this macro trend should consequence in a non-cyclical baseline demand boost, which could be a positive for the steel industry, as this has the potential to make the manufacture less cyclical overall. Another ESG theme that should benefit the demand picture show for CLF'southward products is the rise of electrical vehicles. CLF, as the leading steel supplier for US motorcar companies, believes that its technological leadership in the lightweight steel product infinite will benefit from growing EV adoption, as weight reduction is even more than important for EVs compared to Water ice-powered vehicles due to the heavy weight of the former's batteries. Since steel is significantly less emission-intensive compared to aluminum and carbon fiber (run into presentation linked to a higher place), which are as well likewise expensive for mass-market place vehicles, CLF's light-weight steel offerings could exist important for the EV industry, providing for an attractive market opportunity that should materialize over the coming one to 2 decades as the industry is moving towards EVs.

What Is The Forecast For CLF Stock In 2022?

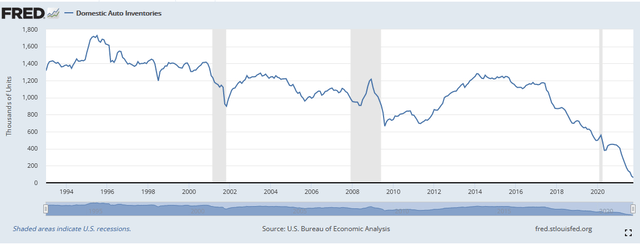

In 2022, Cleveland-Cliffs should exist highly profitable as well, although the company will not necessarily generate the huge profits we are seeing this year. Still, due to contracts for early on 2022 being fixed already, and due to a special situation in the machine industry, 2022 will exist a manner-in a higher place-boilerplate year. Automobile inventories are at an extremely low level right now, due to the global bit shortage and high demand:

Source: stlouisfed.org

Auto companies will exist inclined to rebuild inventories over the coming quarters, which will be a positive for steel demand from the auto industry -- CLF, as the core supplier to the industry, should benefit from that.

Cleveland-Cliffs is forecast to earn around $5.30 next year on a per-share basis, which is about 15% less than what the market place is forecasting for the current year (earnings per share of $6.thirty). If ane were to put a 10x earnings multiple on that, one would arrive at a $50+ toll target, merely I do not deem this realistic at all. Instead, since it is expected that 2021 and 2022 volition be outlier years and that profitability volition be lower beyond that bespeak, one could accept a different arroyo.

The forecast for 2023's earnings per share is significantly lower, at $2.60. Information technology seems more likely that profits can be sustained at that level, on average, in the future, although profitability volition still see some swings over the years. If we were to put a 10x earnings multiple on that we get a share price of $26, and when we likewise account for above-average profitability during the current quarter and next yr, we could add another $3 or then per share to get to a $29 target -- which is slightly less than, simply relatively close to, the annotator consensus cost target. I do believe that the high $20s level could be a realistic fair value estimate for the cease of 2022, but it is, of class, far from guaranteed that this level will be reached. When we consider that CLF is still a cyclical company that experiences considerable swings in its profitability, investors may also want to adjust their fair value estimates for that.

Is CLF Stock A Buy, Sell, Or Concur Now?

Cleveland-Cliffs is, relative to peers, well-positioned in markets such as automobiles, has ESG tailwinds (compared to other steel players), and will be highly profitable in 2021 and 2022. I do believe that 1 can argue for a materially college fair value compared to the electric current share price, and analysts as well see upside potential towards $30. The manufacture seems to be out of favor right at present, all the same, and with COVID worries looming, it may not be the best time to enter a position in a cyclical visitor such as CLF. I am neutral to moderately bullish on CLF and would rate it a Hold right now, although more than risk-hungry investors may want to utilise the contempo selloff to enter a position.

Is This an Income Stream Which Induces Fear?

The primary goal of the Greenbacks Catamenia Kingdom Income Portfolio is to produce an overall yield in the 7% - ten% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's toll can fluctuate, merely the income stream remains consistent. Start your free ii-calendar week trial today!

The primary goal of the Greenbacks Catamenia Kingdom Income Portfolio is to produce an overall yield in the 7% - ten% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's toll can fluctuate, merely the income stream remains consistent. Start your free ii-calendar week trial today!

Source: https://seekingalpha.com/article/4473281-cleveland-cliffs-stock-forecast-2022

0 Response to "Is Cleavland Cliffs Going to Pay a Dividend Again"

Post a Comment